Personal Bill Management

We’ve all been there. No matter how hard you work or how often you pay, bills just seem to keep showing up. Some are regular monthly expenses and others past debts you’d almost forgotten about. You may get them in the mail or manage your bills online; you write a check to make a credit card payment then use a credit card to pay bills online. It’s like a never-ending cycle sometimes.

We all worry about being able to pay for everything, but often that’s not really the problem. You can afford what you owe – well, mostly – but keeping track of everything is about to do you in.

You need a personal bill manager and you need it yesterday. The ability to get everything organized (and keep it that way) without it taking hours every week could save money on bills every month just by avoiding late fees and additional interest charges. That’s before we even factor in the reduced stress that comes from reduced clutter and worry!

If you’re a small business owner, you could conceivably hire an employee whose job it is to take care of these sorts of things, but you’re not sure you want the company’s detailed financial information being handled that way. You could hire a bill management service, but that’s expensive and takes away too much of the control you need to make decisions day-to-day, or even hour-to-hour. For those of us simply trying to go to work and keep food on the table, neither of those are even options. So we do our best – I pay my bills, and you take care of yours, and then we try not to think about it until next week.

The good news is that you don’t have to hire someone to do your personal bill management in order to get control of your regular monthly expenses. The best way to manage bills is being built right here, with Billry.

It’s about more than online personal bill management. More than a handy personal expenses list. More than an app to keep track of bills. That’s unified finance. That’s putting “personal” back into personal bill management.

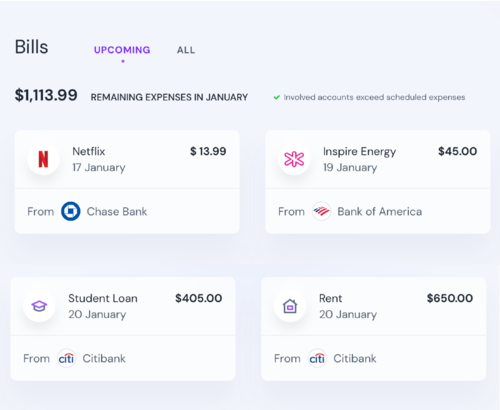

If time is money, the conversion rate must be steep. In today’s world, time often seems like our single greatest commodity. The number one thing any personal bill management app or online billing for small business has to do is reduce how long it takes to organize, analyze, and resolve your monthly bills. The best app to keep track of bills or provide other bill assistance is the one that’s easiest to use. Personal bill management should be flexible and powerful enough to handle your specific ebill needs but streamlined and intuitive enough that you can be up and managing in less time than it took to make the actual payment. Choose a "quick alert" if you decide to add an account, or let the app help you analyze the bill and resolve any concerns.

Maybe you have time to kill and prefer opening countless envelopes and looking back through old check registers to figure out if you paid this one already. That’s your call. We’ll be over here reading, cooking, watching a show together, or finally getting caught up on that laundry. Personal bill management may not make adulting fun, but it certainly frees up the time to try other things which might.

Analyze your spending habits to make more intentional choices and take more effective control of your personal or small business budget. Avoid unnecessary late fees or additional interest from overlooked due dates or misfiled paperwork. You know how often it’s the little expenses that add up to uncomfortable shortfalls; it turns out the same thing works in reverse. Cut a few dollars here and eliminate a few charges there, and before long, you notice there’s money left over – even before payday comes again.

Notice trends in your utilities that may have been there before, but are obvious now that your personal expenses list can be graphed and evaluated with a click or two. Catch problems with recurring charges to your credit cards or challenge rate increases you my not have noticed otherwise. It’s not about pinching pennies; it’s about responsible attention to the little things which so quickly become the big things. It’s about being intentional with our resources and making sure our spending reflects our priorities, whatever they may be.

And do you know what happens when you make every payment on time month after month? Your credit history reflects this new you. Your credit score starts to rise. The next time you look into financing a vehicle, buying a home, or taking out any other kind of loan, you’ll discover a wider range of lenders eager to offer you more competitive terms than you could have imagined. That means buying a car or truck costs less because you qualify for better interest rates. It can mean a difference of thousands of dollars when taking out a mortgage, solely because you spent a few years getting your credit back on track, or strengthening your existing scores.

The best bill management app in the world is still primarily about managing your bills online or via your phone. Every time you take more effective control of one part of your personal or small business finances, however, it has a positive ripple effect on all the others. When you click and follow through on that “Bill alert” you’re also clicking “build credit” and checking in at “strengthen future.”

Or you can keep sorting through that mail. It’s your call.

There’s a personal cost to disorganization and frustration beyond the financial or efficient use of your time. It saps your energy and makes it difficult to focus on the people and goals we care about the most.

Misplacing a bill or being late on a single payment isn’t the end of the world, and it doesn’t make you a bad person or an irresponsible caregiver. What it can do, however, is chip away at our sense of having things under control, of being capable adults taking care of ourselves and those we love. Like the slow drip, drip, drip that eventually carves out a Grand Canyon, when you can’t keep track of bills and payments, it makes it harder to stay focused on other things which matter more.

One late payment isn’t enough to ruin your credit, and one bill paid in full isn’t enough to magically fix it. One harsh word won’t destroy a strong relationship, and one thoughtful act won’t heal a broken one. Most things, good or bad, take time and consistency. Some take buy-in from others beside you. That doesn’t mean we shouldn’t all do what we can. Making that one payment on time matters. So does that one thoughtful act. The same is true when it comes to maintaining the world around us.

Managing your bills online or through your preferred app means less paper, less material wasted, less mail being driven and flown around the country, less fuel consumed (and less adhesive being licked - yuck!) No, online bill payment probably isn’t going to immediately save dolphins or reverse the greenhouse effect – but it’s not going to make either situation worse, and may help things get a tiny bit better.

Like your credit history, or even your relationships, enough little things – good or bad – add up over time.

If all you’re looking for is the best app to keep track of bills, the best source of online billing for small business, or other related tools for small business or personal bill management, we’re glad you’re here. We’ll soon be rolling out our own upgraded bill management service allowing you to do everything from making a credit card payment to analyzing your personal monthly expenses to designing an ebill for your own online store. Like with everything we do, our goal is to offer you enough power and flexibility to manage your specific circumstances while keeping things simple and intuitive to use.

If that’s enough, and the only reason you’ve come to this part of our Goalry Financial Mall, that’s awesome. Welcome. We’re glad you found your way to us, and we’d like to do whatever we can to help while you’re here.

Just so you know, however, taking advantage of the tools and information offered here at Billry gives you the same access to our sister sites and anything they have to offer as well. If you’re considering refinancing your mortgage, we have information and insights you might want to check out over at Loanry before making your final decision. If you’re worried about your retirement options in times of job insecurity, you’re not alone – it’s a regular topic over on Wealthry. Need some ideas on effectively using a household budget and advice for cutting utility expenses without sacrificing comfort? Head on over to Budgetry, the closest sister site to Billry, and get a head start on taking better control of your income and your out-go. Assessing real estate, preparing for tax season, managing debt – it’s all here, and growing exponentially as more and more Americans discover the simple power of unified finance.

We have this crazy idea at Billry, and across the Goalry family, that while money management isn’t always easy, it doesn’t need to be as complicated and scattered as it often seems. We believe that with the right information, tools, and connections, most of us are perfectly capable of taking more effective control of our personal or small business finances.

That’s why we created (and continue to expand) the Goalry “finance mall” – ten interconnected “finance stores”, each designed to simplify your personal or small business finances. Whether it’s real estate, taxes, investments, budgeting, debt management, loans, or simply checking your credit score and credit report, Goalry means access, information, and connections to the services you decide you need.

At Billry, that starts with better ways to keep track of bills and payments. This is the 21st century, and while piles of unopened mail or scribbled reminders on legal pads may be quaint, they’re not always efficient or entirely effective. There’s simply no excuse for not taking advantage of the many flexible and creative personal bill management tools available online or as downloads. The next time you’re digging around for the next stack of sequential paper mail, just as you realize you haven’t paid one portion of your bills, imagine instead that you’re picking up your phone and opening your preferred app to keep track of bills due, reference your personal spending tracker, and save with a click or two.

Which method do you think is the best way to manage bills?

And if you ever start feeling nostalgic, don’t worry – you can always just dump the paper recycling on your desk and dig through it for old times sake. Once you’ve started using your preferred bill and expense tracker online or downloaded to your phone, you’ll probably have the time to indulge yourself, if you so choose.