Track Your Bills.

Manage Spending.

Track bills and get tailored insights on ways to save. Use the spending versus income tool to know exactly where your money goes.

Track bills and get tailored insights on ways to save. Use the spending versus income tool to know exactly where your money goes.

Connect all your accounts and monitor all your transactions in one place – automatically cleaned and categorized by Billry.

Figure out how to lower monthly bills, feed a large family on a tight budget, and have other money-saving ideas popping up when you need them.

Get a comprehensive view of your money health and the steps needed to improve it. Your financial goal score is generated based on spending, saving, and borrowing behaviors.

Get access to 3 finance stores for free and start your journey towards financial freedom.

Tracking your spending and bills is essential if you want to save money. Billry and other finance stores help you know exactly where you stand.

Get a weekly, monthly or yearly customized analysis of your income, spending and savings to help you make more informed decisions about where your money goes.

See how much you spend in each category, choose a time frame and get a visual of your spending.

Access tools to help manage spending habits and stay on track!

Connect all your accounts and monitor all your transactions in one place. Having your finances and billing at your fingertips or a few clicks away on any connected device is finally possible.

With an automatically cleaned and categorized list of transactions you’ll be able to work with them and review them more easily.

Figure out how to lower monthly bills, feed a large family on a tight budget, and have other money-saving ideas popping up when you need them.

Get suggestions about educational videos and blogs that can help you manage your bills and save money.

If you're a big coffee lover like me, that can have an impact on your finances. So how do you save money on coffee while preserving the taste and quality? Here’s my quick, tried, and true guide!

Whether to go to college or a vocational training center, many leave the family home and begin to bear all or part of their own expenses. Therefore, it is important to know where to find student discounts. We have some useful tips for getting student discounts, you just need to keep reading.

You can improve your financial situation by following some helpful tips on how to spend less money. While it can be challenging to cut your spending, you might find it easier than you thought if you put some research into it. Here are 20 simple tips that you can use to reduce your spending.

In this article, we'll answer the question “how much does it cost to move?” for you and discuss how working with Goalry can help you save money or fund your new moving experience.

Are you interested in installing a real home theater in your home? Maybe you dream of watching your favorite movies on a large screen with surround sound. Keep reading this article in which we break down the cost of installing a home theater.

A home gym can save trips to the gym or checkout at rush hour, allows you to train at the time that is most convenient for you and you can use any material you need without ever expecting them to be available. If this was what you were looking for to gain more motivation, then this article is perfect for you to help you outline some of the most important steps to keep in mind when planning to build a home gym.

Have you ever thought of learning from home instead of going to a learning institution? This is not something new in America because many people have been doing it for years. However, before you decide whether to enrol in an institution or learn from home, it is important to understand the benefits of each option.

Eating out every day for lunch gets expensive quickly. In addition to it being a hit to your budget, eating out may not always be the healthiest way to eat. These helpful and tasty tips contained in the article will help you save money on lunch and eat well.

Are you getting married soon? Congratulations on such an important step! The problem is, this happy event can be particularly costly. However, do not panic! We have some great ideas for saving money, you just have to keep reading.

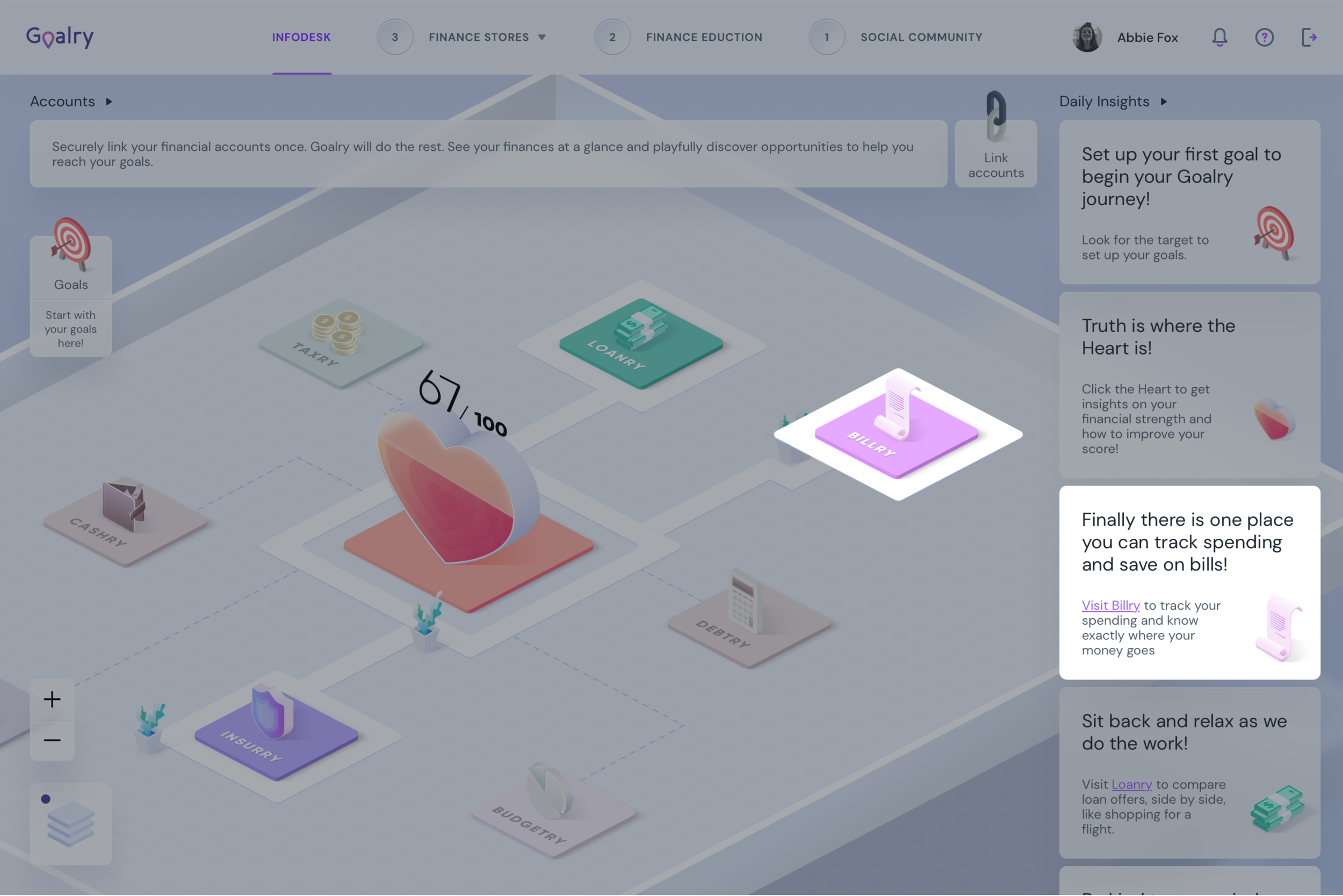

All your goals and dreams in one place

"The Heart" is the Center of Your Financial Goal Mall. The heart includes a financial health scoring tool based on financial behaviors. It takes complex data about your life (credit, spending, savings habits and much more) and breaks it down into an easy-to-understand score.

After clicking on the heart you'll see key indicators that impact your score and actions you can take to improve your financial health using the stores.

The entire Financial Goal Mall is actionable to help you reach your goals. Discover custom experiences and get tailored insights using each of the finance stores all the way to retirement.

Financial goals require long-term planning. The goal management tool allows you to visualize your plan using an interactive timeline with automatic calculations.

Each goal you create will be tied to only one of the accounts you’ve added — except retirement goals, which can be tied to multiple accounts.

Most of us don't know where to start when it comes to improving our financial health. For some, handling their finances is akin to driving with a blindfold on. This is often why many people don't know how to stop living paycheck to paycheck.