How to Cut Bills on the Family Budget: Saving 411

Paying bills is never fun, but it is even worse when every penny you make goes to barely keeping everything on. At times like these, you tend to live out Bon Jovi’s “Living On A Prayer”. Or is that just me?

When you live check to check, you have no time for anything, especially not being sick. I used to be fussed at working when I was sick, but really, who can afford to take a day off? All it takes is one day to throw yourself off track but a year to get back on it. Okay, maybe a year is an exaggeration- slightly- but it sure feels like a year.

Either way, it really is no way to live. We all need to save and invest, but who can afford that? Bills take it all, and they seem to grow. So what do we do?

I can honestly say that with a six-person family, I have almost become an expert in living on a dime and have learned tons of ways to cut bills on the family budget. I would like to share those with you.

Get Determined

The first step to effectively cutting your bills is to get determined to do so. Have you ever been so angry at something that you just had to fix it because you refuse to deal with it anymore? That’s what we are doing here.

Of everything I have ever tried concerning my bills, I never really did well with it or kept it up until I got mad. I allowed myself to get so angry with the way that we were living that I absolutely refused to let us live in that financial state another second. You have to decide that you are through with your current state or you might let yourself off the hook. That’s not what you want- you want a different life. So get angry and determined to make that new life happen.

What’s Your Why?

Now, why exactly are you doing this? It is not enough to say, “I want to cut bills on the family budget.” You need to be specific. Paint a picture for yourself. Your why should be something like:

I am tired of telling my kids ”no” every time they ask for something

I want to be able to pay cash for Christmas

I want to go on a vacation we will really enjoy

I would like to retire at 40 so I can pursue my dreams

I want to start a business

I want to save $1 million

I want to go on a mission trip to Africa

I want to house the homeless

I just want to pay off debt so I can breathe

Get the point? Yes, you want to cut bills on the family budget but why? What will you do with that money? Your why is all yours. No one else needs to know it - unless you want to share it - and no one should judge it. However, you do need to name it so you know what you are working toward.

At this point, it might be helpful to make a vision board or goal chart - or both. Keeping a reminder in front of you of why you are working so hard and how much progress you are making can push you forward.

Set a Number

Now, you need to decide how much you want to lower monthly bills. How much do you need to cut bills on the family budget to reach your goals? Come up with a concrete number to work toward.

Now, to cut bills on the family budget, you need to do a little prep work.

- Gather All Bills And Receipts And Bank Statements

Anything you have that shows how much money is going out needs to be placed in one spot.

- Create a Budget

You also need your budget here. If you do not have one, you need to be making one during this process. Budgets are vital to financial success.

- Make a Date With Yourself

You really need time to focus and make phone calls, so clear out a day on the calendar for you to do this.

- Prepare for Writing It All Down

Get a notebook, pen or pencil, phone, laptop or tablet, calculator, and something to drink.

A small snack is helpful, too. You will be sitting here for a while, so you want to be prepared. - Consult Other Family Members

If you have little ones, try to have someone else watch them for the moment.

If you have a spouse or older kids, it would not hurt to involve them in the decision-making, but remember that you are the one paying the bills, so the ultimate decision is up to the parents.

Alright, it is time to dive in. Take a deep breath and let’s get to work.

Make a List

Right now, make a list of everything you are spending money on - bills, debts, school fees, anything. Try to categorize- you can do this on paper or in a computer program like Excel. The most common categories will be things like:

- Utilities

- Cable

- Cellphones

- Home phone

- Subscription

- Memberships

- Planned Spending

- Unplanned Spending

- Groceries

- Car Insurance

How To Bill Shop? The Billry Is Here To Help.

You may not have all of these or you may have other ones. Whatever you spend money on, categorize it. You do not have to categorize your spending at Walmart for a year. You just need a monthly average.

Now, take a look. What do you spend the most on? Most likely, your utilities will be the biggest spending, but yours may be much different. Regardless, to make the biggest impact, it helps to start with the biggest category. We will be going over how to cut bills and spending in a moment. For now, just get an idea of where your money is going.

By the way, some online checking accounts categorize your spending for you, so take a look there before you do it all yourself.

Understand Your Priorities

I want to make a very big point before moving on: Your goals and priorities should always play a big part in your budget, and they should not be compromised if you can help it at all.

For instance, dates with your spouse are important. They help to hold your relationship together. Yes, you can exchange eating out for a fun night at home, but if you have little ones, you might only get quiet if you go out. You do not have to shave this out of your budget because it is important.

You can work to find cheaper ways to go about it, but do not risk the health of your relationship to spare a few bucks. On top of the emotional turmoil, separations and divorces cost a lot more than having dinner.

Your priorities might include family pizza night, yoga class, or anything really. If it is important, do not just completely disregard it. Look for ways to be cheaper with it but do not discard it altogether.

Groceries

In all honesty, groceries are quite often one of the best places to start when you are trying to cut bills on the family budget. This is because there are many ways to save and still eat well. Since there is a ton of information available online for this topic, I’ll keep this brief. Here are a couple of ways you can save on groceries:

- Make a menu

- Shop with a list

- Use apps like Ibotta, Shopkick, Flipp, and Fetch Rewards

- Shop at multiple stores

- Start cooking homemade food

- Grow a veggie garden

Utilities

Utilities- meaning electric, gas, and water- are often some of the hardest to cut down, though they are not impossible. Mostly, it is about changing your habits.

- Do not leave lights on when you are not in the room.

- Make sure you do not leave the water dripping.

- Take shorter showers.

By cutting your usage, you cut your bills. However, there are a few other things you can try.

Some states- not mine, unfortunately- have more than one of each type of utility company. Compare rates with them both. Also, check-in with any programs they have. Some electric companies offer discounts or lower fees if you cut down your power usage between certain hours. You never know until you ask.

Other Bills

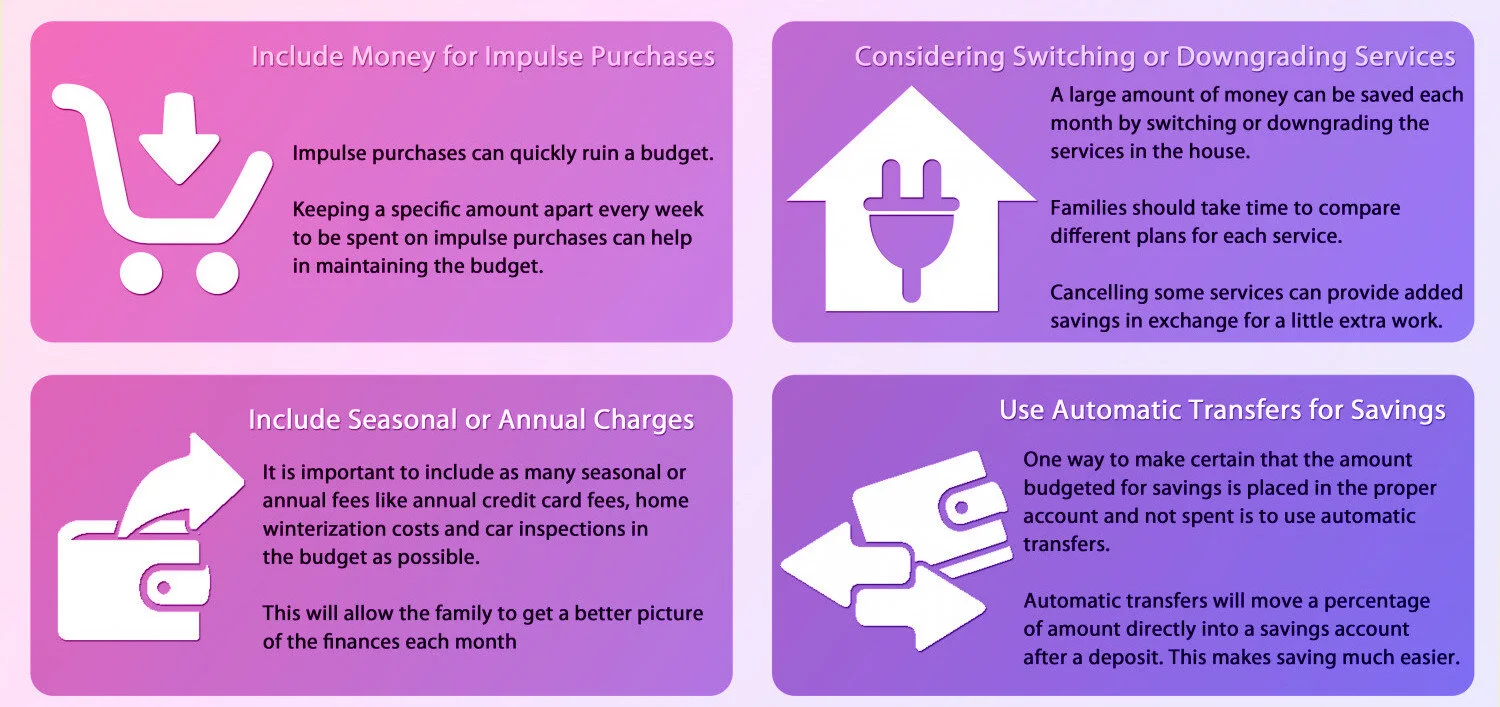

Here we are referring to things like cable, internet, cell phones, insurance, and so on. These can actually be cut down pretty easily.

First of all, do you even watch your cable? Most people do not. If they do, it is normally for one or two shows. Guess what- you do not need cable for most shows. Most cable channels now have these nifty little apps that let you watch their shows. CBS, AMC, Lifetime, ID TV, Nick, and many others do. Some of them charge a monthly subscription, but we are talking a few dollars.

A few months ago, I got rid of my cable. I wanted to get rid of it years ago, but in my area, you could not get the internet without cable. Since I work online, the internet is a must. However, a few months back, I found out that you could now get the internet without cable. I jumped on it immediately and I now save $170 per month. You do not have to just let it all go, though. You can still use subscriptions like Netflix for movies and such. And Redbox is an incredible thing.

Also, your local library carries movies, especially ones for kids, so take advantage. If you do not want to get rid of cable altogether, give your cable provider a call. Tell them you are considering changing providers and want to know if they have a better package. Quote a price you saw on a competitor’s ad and ask them to match it. No business wants to lose your money- especially not to a competitor- so more often than not, they will negotiate rates with you.

Outside of cable, your cell phone may be expensive, but it does not have to be. StraightTalk offers unlimited talk, unlimited text, and data for only $45 a month. They have cheaper plans, too. And, anyway, if you have internet and are at home most of the time, how much data do you really need? I have heard of plans costing less than $20 per month for people who do not need tons of data.

Some people still have a landline. I am not completely against having one. It gives my kids a way to talk without all needing a cell phone or fighting over mine. However, if you have one and no one uses it, cut it off.

A lot of people pay for things that they do not need. Take a real and honest look at your bills. How much of what you pay for is really getting used? Cut anything that you do not need or use. This will probably cut bills on the family budget more than almost anything else.

I am currently looking for new car insurance. It is something that everyone should do at least once a year. Compare rates with other companies. You may have the best one but it is best to be sure. Just imagine if you could cut your monthly insurance payment in half! Never be complacent.

I know that I just said to have Netflix instead of cable, but that is only a good idea if you actually use Netflix regularly. This goes for other subscriptions, too. Do you really need the daily newspaper delivered to your house? Would it not be cheaper to pay for an online subscription? It would not clutter up your house, that’s for sure.

Just take a look at any subscriptions you pay. Are they worth the price? If not, cut them.

Remember about nine months ago when you got this really amazing offer for a gym membership? Remember how excited you were and how determined you were to be there every single day and get in shape? Well, did you? Probably not. The truth is that only a fraction of those who pay for a gym membership actually use it, so do not feel too bad. You are not alone.

However, it is time to face the facts: you do not need to keep paying for that membership. If you do not use it, do not pay for it.

Now, as I am an advocate for health and fitness, I am not telling you to give up on your goals, but you can get in shape without those crazy membership prices. Here are a few ways to do so:

- Workout videos- either on DVD or on YouTube (trust me, they work- and you can do it in the comfort of your own home)

- Invest in some home equipment- punching bags are awesome for cardio, and to relieve stress

- Get outside- sometimes the best thing to do is go outside and play with your kiddos

- Start walking with friends

Your Spending

When you start looking at how much money you spend, you may be surprised. Most people spend a lot more than they think, especially on unplanned purchases, like the candy bar and soda every time you get gas. Take a look at your receipts and get an honest look at how much you usually spend.

If you need to cut down on spending - and we all do - there are a few things to do. First, for planned spending, such as buying household essentials, use the same tactics that work for grocery shopping. For unplanned expenses, there is a really good trick - it can actually work for your entire budget and all spending.

Try the 'Envelope Method'

Here it goes: Have a plan and use cash. On payday, get your money out of the bank. Separate that money into envelopes for everything you need to do, such as bills, groceries, and so on. Then, when you stop to put gas in your car, you only have the amount that is in your envelope for gas. Impulse purchases will decrease astronomically.

Debts

If you want to cut bills on the family budget and part of those bills are debts, try calling your creditors. Often, you can negotiate for better interest rates or a lower settlement amount.

A Few More Tips To Cut Bills On the Family Budget

Though ways to cut bills on the family budget are nearly endless, we cannot list them all here. Instead, here are just a few more tips to get you rolling:

Declutter

I am not joking. Clean out your house. Do you know how much money people spend out every year replacing things that they simply cannot find? Clear out your house, sell your stuff for some extra cash, and find the things you need before you spend unnecessary money.

Homemade Cleaners

Homemade stuff is not just good when it comes to food. Homemade cleaners are both cheaper and safer, and there are tons of recipes online.

Used is Okay

While I would never suggest you buy used undies or socks, most used items are okay. Before spending a ton at a retailer, take a look at thrift stores, on Facebook, and on Craigslist.

Layaway

If a store offers layaway, go for that instead of using a credit card.

Conclusion

There are so many ways you can cut bills on the family budget. With some time, some honesty, and a little effort, you can save hundreds or more every month. Take the time to invest in your future by working to cut bills on the family budget now.