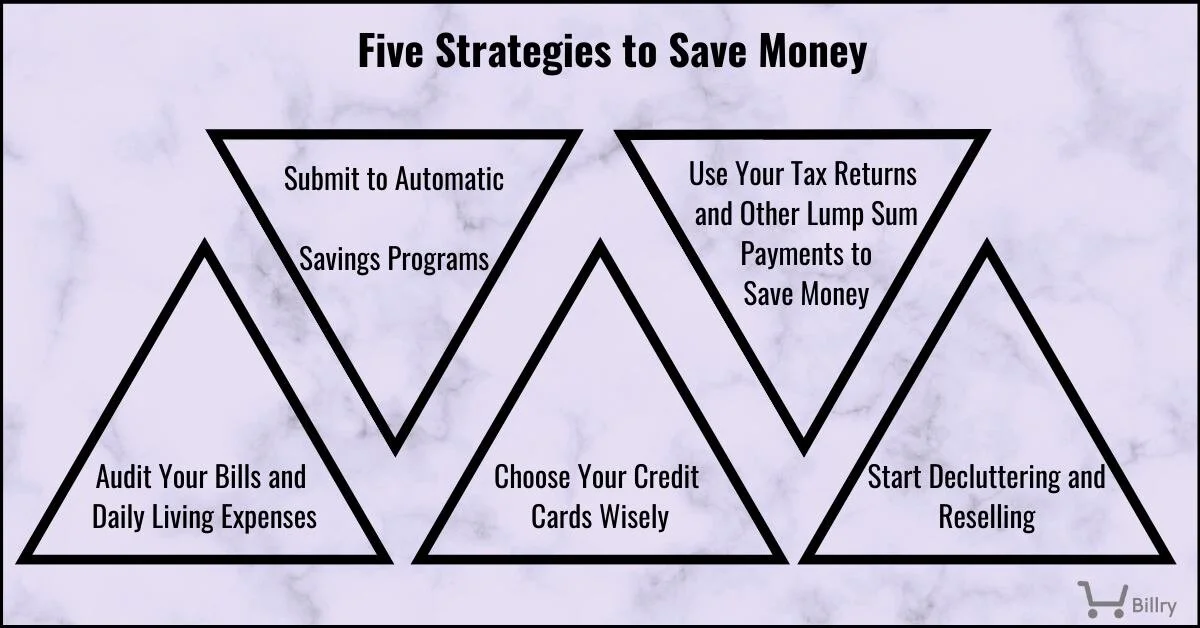

Saving Money on Any Income - 5 Strategies for the Rich and the Poor

Learning how to start saving money on any income is easier than you may think right now. I’ve used quite a few strategies to save over the years, and I’ve faced challenges at varying income levels. At one point in time, I was the single parent earning minimum wage with babies to feed. At another point, I was earning good money but couldn’t manage to save a dime of it. I’ve lived paycheck-to-paycheck, and I’ve had six figures in my savings account.

Through those experiences, I learned the importance of saving regardless of earnings. Whether you’re currently stressed out from a pile of debt with minimum earnings or you’re rolling in cash and want to make smart financial decisions, now is the time to learn money-saving skills that will ensure stability and security for you and your family.

1. Audit Your Bills And Daily Living Expenses

When thinking about saving money on any income, many people skip their bills and basic living expenses. They assume there’s nothing they can do about how much they pay for electricity or the cost of car insurance. Maybe you’ve thought the same, but there are ways to reduce your bills and living expenses so that you can save money.

It may take a bit of time to fully audit and correct your current bills and living expenses, but doing so will ensure the bills and expenses you pay are essential and reasonably priced for the current market. We’ll break it down for you step by step to make it as easy as possible.

Make a List of All Bills and Expenses

Include everything from your mortgage or rent to that $10 Pandora subscription or your child’s Playstation Network addiction. Everything that you spend money on should make an appearance on this list along with how much it costs you monthly.

If some expenses aren’t the same every month, comb through your bank statements and come up with an average for the last three months. It’s a good idea to go through your statements anyway to pick up those small automatic charges that you my not think about regularly.

Good news for you. You’ve done the most time-consuming part of an expense audit once this step is complete.

Categorize Your Bills and Expenses

This step is just like going through your closet and deciding what to keep, give away, donate or trash. Go through your list and mark each expense into one of the following categories:

- Keep — These expenses are essential and there is no way to reduce them in any way. You may assume that most of your bills will fall into this category, but that’s usually not the case. There are ways to reduce the cost of many bills. For example, your car insurance wouldn’t fall into this category because you can compare prices online and probably find a cheaper deal for the same coverage. That’s especially true if you automatically renew your policy with the same company every year without even considering other options.

- Reduce — These expenses are essential, but it’s possible you can get a better deal with a little effort. Most insurance policies are good examples because you can compare prices online to see if a better deal is out there with a reputable insurance company. You may also include expenses like groceries or fast food in this category if you know you could spend a little less in those categories. For instance, you might start using coupon websites to reduce your grocery spending.

- Eliminate — These are the bills and expenses that you can live without to make saving money on any income easier. Maybe you have a Hulu subscription but you rarely watch anything through the service. If this category remains empty at the end of this step, challenge yourself to eliminate at least one small expense. Most people have one thing they spend money on that isn’t as important as their reasons for wanting to save money.

- Temporary — You may not have anything in this category, but it’s important to understand it anyway. These expenses are essential right now, but you know you won’t need them in the long term. Perhaps you’re paying for driver’s school for a teenager or you only have two more payments to eliminate your car payment from your budget.

Follow Through with Your Audit to Reduce Expenses

You’ve completed a full audit on your bills and daily living expenses. Now it’s time to do something with the information you’ve gathered and the decisions you’ve made. Your keep category is complete, but you have some work to do on all expenses in the other categories.

- Reduce — Go through this category and take steps to reduce those expenses. You may end up switching to new loan lenders, consolidating credit card debt or making a lump sum payment to dramatically lower an expense. These actions will free up money in your budget for savings.

- Eliminate — It’s time to cut the cord for every expense on this list. You’ve decided that you could go without these expenses, now follow through with action. It’s sometimes as simple as canceling a subscription but may take direct contact in other cases. If you’re eliminating a daily living expense that isn’t important now that you have savings goals, think of creative ways to remind yourself to skip it next time the situation arises.

- Temporary — Set a specific expiration date for these expenses. Hang the list on your refrigerator, in your office or somewhere else noticeable. Make sure to cut these expenses off when their expiration date arrives.

Compare and Save

Your living expense audit is done, and you’ve completed the first step to saving money on any income. If you add up all your expected monthly expenses based on this new arrangement, you should find that you’re paying out less than you were before the audit was complete.

If not, you were either already living extremely frugal or you need to go back through your expense list and require yourself to cut out or reduce unnecessary spending. Learning how to save sometimes requires hard decisions and tough love. If you don’t want to reduce or eliminate bills or expenses, keep reading to discover other strategies for saving money on any income.

2. Submit To Automatic Savings Programs

Many banks now offer programs that automatically transfer your change from checking to savings when you make purchases. When they transfer and how much varies by program, but the general idea is to round up to the next dollar and transfer the difference to your savings account. You won’t likely miss those small deposits of change, but they can help build your savings account a bit faster.

If your bank doesn’t offer this type of program or you want to maximize your automatic savings, set a portion of your paycheck to go directly into your savings account. You can do this with most companies that offer direct deposit just by opening an app and designating where you want each percentage of your paycheck to go. If not, check your banking options to see if you can set up an automatic transfer from your checking to a savings account on your paydays or once a month.

Automatic programs only help you save if you set them up and then forget about them. If you dip into your savings needlessly because you know that money is there, it won’t accumulate and help you save.

3. Choose Your Credit Cards Wisely

Where you stand with credit cards likely depends on your income level and financial integrity over the years. Credit card companies consider how much money you earn and your credit score when approving or denying applications. The better you manage your bills and money, the higher your credit score is likely to soar. That can help you gain acceptance for credit cards with lower interest rates and no monthly fees.

If saving money on any income is your goal, you should select credit cards that help you reach that goal. You never want to go into debt with large credit card purchases that you can’t afford to pay off quickly. That alone will ensure your budget isn’t drained paying off high credit card bills for years to come. It’s much better to make small everyday purchases and pay them off within the same month. You’ll keep your credit cards in good standing, your credit score high, and your budget free of excessive credit card debt.

Select credit cards that will help you save money

Travel Credit Cards — These cards allow you to earn points that are redeemed to lower your travel expenses in the future. For instance, some cards allow you to earn free hotel stays while others offer airline miles. You can also use some cards to reduce transportation expenses when you travel.

Gas Rewards Credit Cards — Some credit cards reward you with cashback when you buy gas using the card. There aren’t many genuine gas reward credit cards today, but many do offer perks for gas purchases if you explore their rewards programs.

Low to No Annual Fee Cards — The annual fee on a credit card will cost you money even if you barely use the card. If you have good credit, you should qualify for cards that have a low annual fee. Some have no annual fee, and those are the best options if you want to save money.

Compare and Look for Better Options

If you have credit cards with high interest rates or annual fees, consider transferring your balance to a credit card with more reasonable fees. If you don’t have many credit cards, consider keeping it that way unless you find a card that offers rewards you can use to save money on travel or daily living expenses.

Always compare credit card offers online before you make a final decision on one card because credit lenders are always coming up with new incentives to secure new accounts.

4. Use Your Tax Returns And Other Lump Sum Payments To Save Money

I’m not going to tell you to simply put your tax returns and other lump-sum payments directly into your savings account. If you could do that, you would likely already have a good chunk of money in savings. You’re likely to have expenses that you need to take care of immediately when you get that money, but you don’t want to start blowing the rest on high-dollar purchases that you don’t need or expensive dinners out.

Since saving money on any income is your goal, there are ways to use that money to hit your goal faster. Even if you only have $200 left after you pay bills and other necessary expenses, there’s a lot you can do to set yourself up for financial stability in the years to come:

-

In general, any debt that has an interest rate in the double digits will cost you too much money to pay off slowly. Use your windfalls to knock out that debt, and then make sure you secure lower interest rates and fees before you take out another loan. Comparing lenders online allows you to get the best deals because lenders will compete for your business.

-

It’s now commonplace for Americans to downgrade their lifestyle when they retire. You may imagine yourself living on the beach in a luxurious condo and relaxing, but that’s not likely to become your reality if you don’t save enough money in advance. Right now is the time to start saving, and investing any lump sums of money you receive is a great way to pump up your savings for the future.

-

Increasing your income allows you to live comfortably while saving more for your future. Depending on the size of your windfall, you may have the option of paying for an educational program that will qualify you for higher-paying jobs. Maybe you can design a website and start selling your artwork or homemade soaps online. Not everyone has a skill or passion that will translate easily into a side hustle, but many do and never take action to make it happen. Just make sure what you invest in will genuinely earn you more money in the future. It’s better to just save the money than to lose it on a venture that never delivers returns on your investment.

Billry Helps You Negotiate Your Bills and Save Money !

5. Start Decluttering And Reselling

I once drove around with a bag of clothes in the trunk of my car for months. My intention was to donate it to Goodwill, but I never made the time to actually stop and donate. I ended up pulling those clothes out and selling them to Plato’s Closet for a little chunk of cash. That gave me the idea to start combing through my home for items that I could resell.

Chances are high that you also have items sitting around collecting dust that could earn you a bit of money. Saving money on any income becomes easier when you sell unneeded items and tuck that cash into your savings account.

I have a few ideas that you can use to declutter, resell and save more:

Resell Clothes Online

Try reselling clothing online. Sites like Poshmark and The RealReal make it easy to earn cash for designer clothing. You can sell used clothing from non-designer brands on eBay, but make sure you’re aware of the fees and carefully consider the cost of shipping before setting your prices. Listing bulk offers of clothing in one size can make it easier to manage if you have a lot of clothing to resell. Shoes count here as well as pocketbooks and fashion accessories.

Organize a Yard Sale

Have a yard sale. If that seems like a lot of work, try to get your friends or relatives involved. Ask your neighbors if they want to have a community yard sale. Get a large sale going at your church or a local social group. Bigger events attract more attention and allow you to have some fun socializing along with the hard work of setting up. You can often get someone to pick up all unsold items for free if you post on Craigslist or local buy, sell, trade groups on Facebook. That eliminates a lot of the hassle of hauling away leftovers.

Use Facebook

Take advantage of buy, sell, trade groups on Facebook. Local groups that allow you to post items for sale free of charge are a gold mine if you have a lot of valuable items to sell. You can meet the buyers in your local community and pocket the full amount of every sale rather than paying fees and shipping items from online sales.

Think In Advance

Don’t declutter one time and get what you can out of it. Moving forward, collect items that you know will make you at least a few bucks if you resell. You can set up at the local flea market, have a sale in your front yard, or continuously run listings for new items online as that pile grows. This can turn into a side hustle that keeps giving. Saving money on any income becomes easier and easier as long as you do the work.

Saving Money on Any Income — Personalize the Goal

Setting financial goals is important regardless of your income level or age. Do you want to save a million dollars? Or do you just want to stop living paycheck to paycheck? Saving money on any income is a good first step toward financial independence, but you still need a specific goal that you can work toward over time.